Depreciation: What it means and how to calculate it

April 20, 2023What is depreciation?

Functions of depreciation

Depreciation expenses (cost of doing business)

Depreciation and tax

Depreciation on your balance sheet and valuing your business

What is a depreciation schedule?

How to calculate depreciation

Straight-line depreciation method

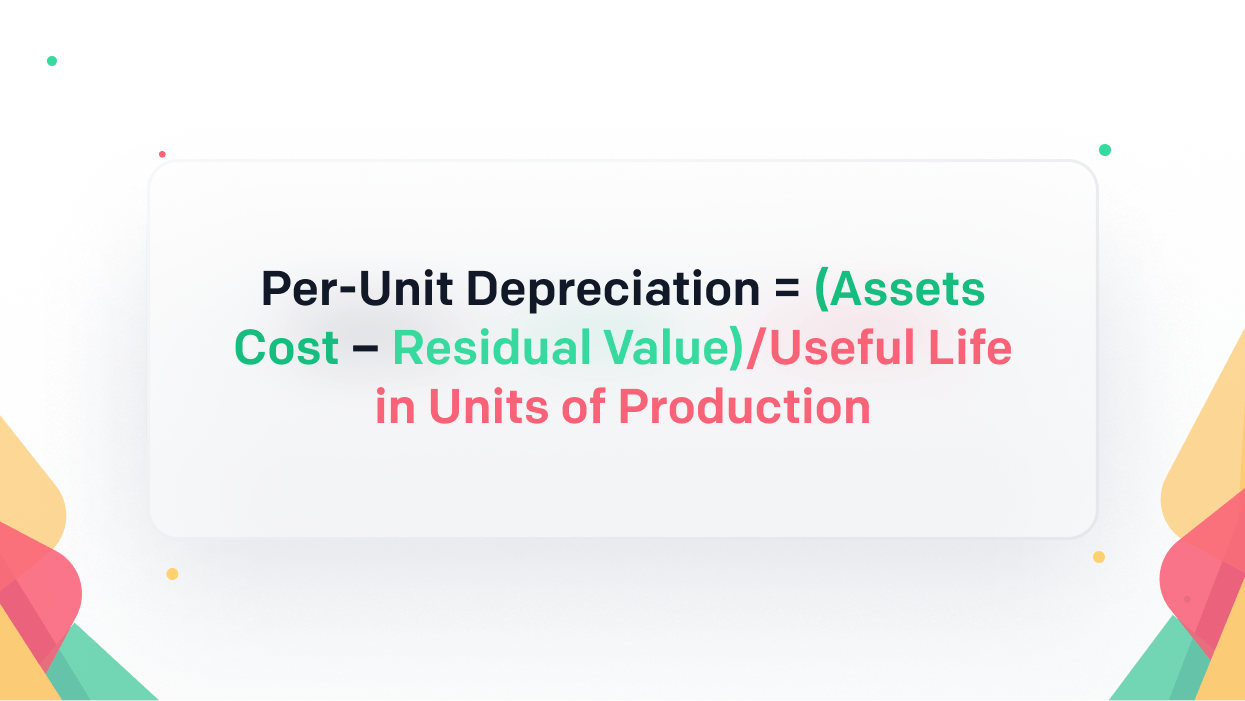

Unit of production depreciation method

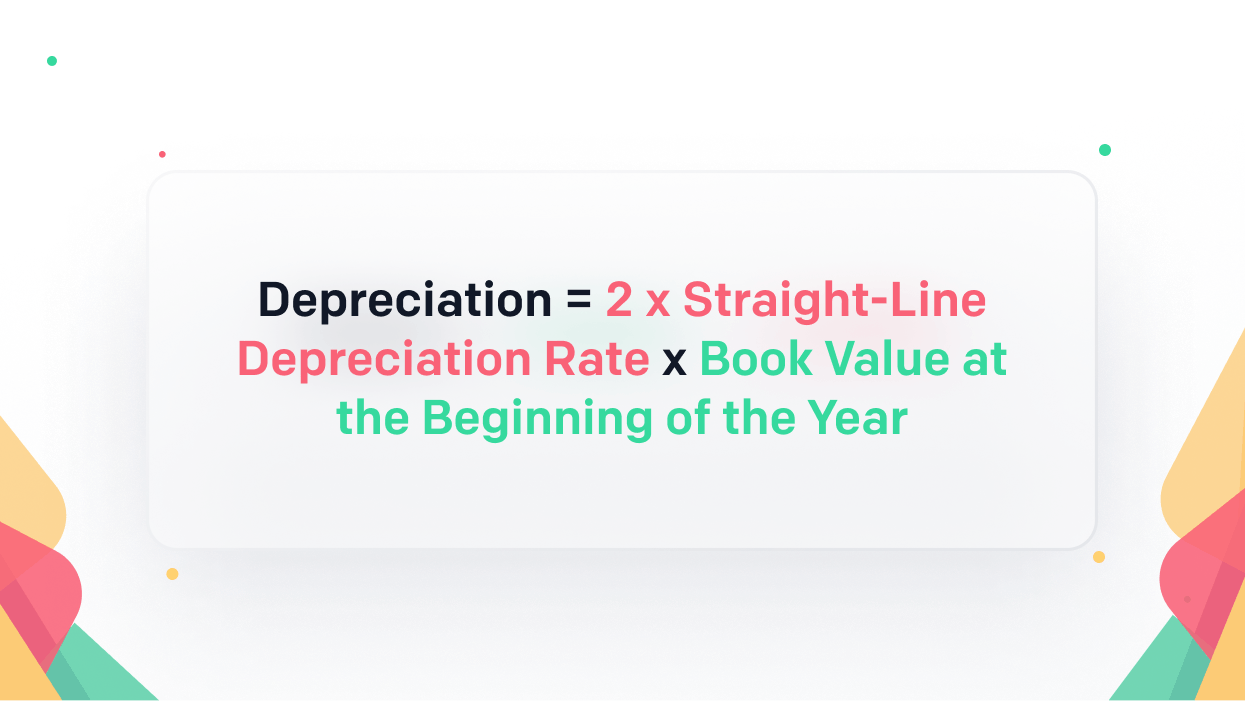

Double-declining balance depreciation method