Contents

How to file a VAT Return: A step-by-step guide

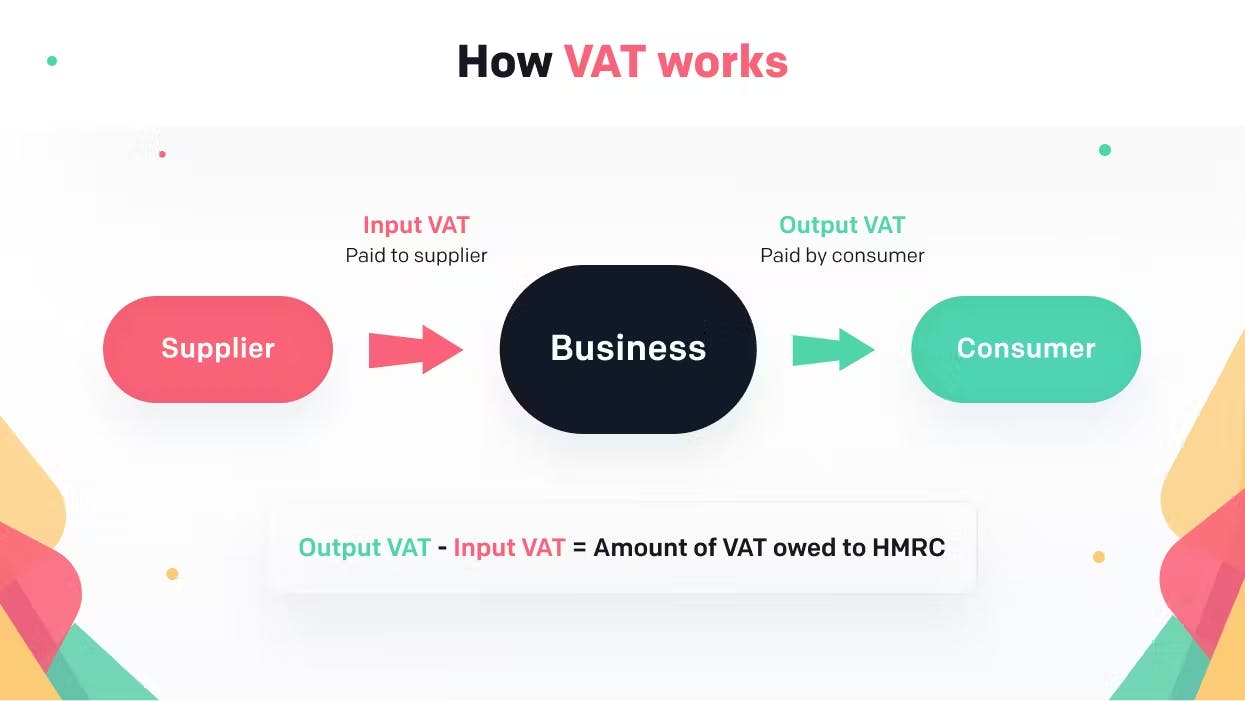

April 24, 2023What is a VAT Return?

| Rate | % | Applicable to |

|---|---|---|

| Standard | 20% | Most goods and services |

| Reduced | 5% | Children's car seats, fuel and power for domestic use, energy-saving materials installed for domestic use |

| Zero | 0% | Books and newspapers, children's clothes and shoes, motorcycle helmets |