Contents

- 1. What are payments on account?

- 2. What does payment on account mean?

- 3. How is my total tax bill calculated?

- 4. What are balancing payments?

- 5. When do I need to pay my tax bill?

- 6. How do I make payments on account?

- 7. How can I be best prepared for my tax bill?

- 8. Can I reduce my payments on account?

- 9. I can't afford my next payment on account. What can I do?

Payments on account: Paying your taxes as a sole trader or limited company

December 20, 2021What are payments on account?

What does payment on account mean?

How is my total tax bill calculated?

What are balancing payments?

When do I need to pay my tax bill?

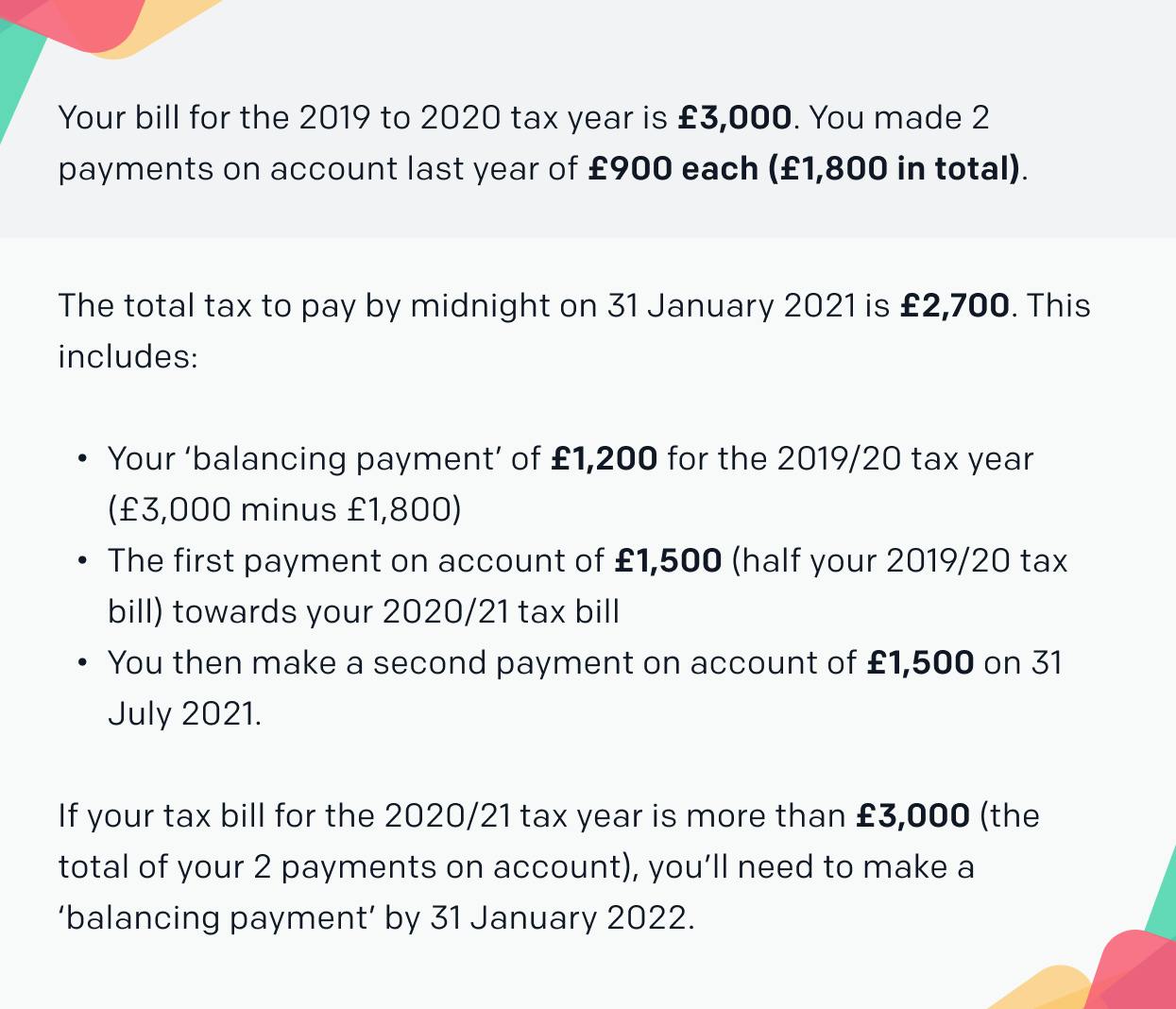

Payment on account example