What is a balance sheet and why is it important?

August 25, 2022What is a balance sheet?

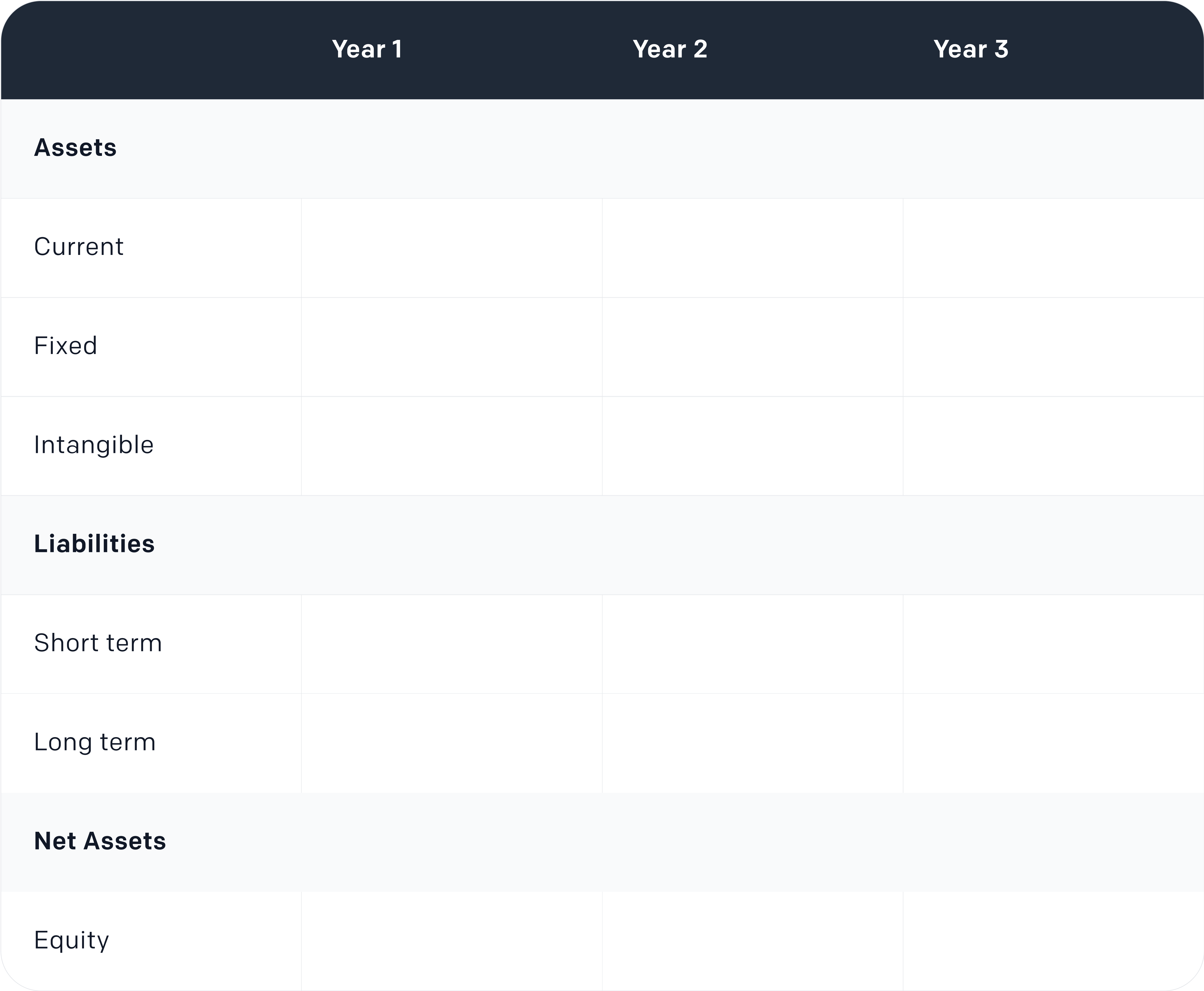

Balance sheet: key definitions

- Net assets — what you own

- Total liabilities — what is owed to outside parties

- Shareholder’s equity or owner’s equity net worth — the total value of assets, minus any liabilities

Assets

Liabilities: balance sheet obligations

| Long-term liabilities | Short-term liabilities |

|---|---|

| Mortgage | Creditors (suppliers you owe money to) |

| Loans | VAT (owed to HMRC if you're a VAT-registered company) |

| Salary | National Insurance contributions |

Equity, explained

Balance sheet example