Contents

- 1. Cost of sales definition

- 2. How does cost of sales differ from COGS?

- 3. What should be included in a cost of sales calculation?

- 4. What should be excluded from cost of sales?

- 5. Cost of sales formula

- 6. Types of stock management and impact on COGS

- 7. How to interpret your cost of sales

- 8. Limitations of COGS

What is cost of sales?

February 8, 2023Cost of sales definition

How does cost of sales differ from COGS?

What should be included in a cost of sales calculation?

What should be excluded from cost of sales?

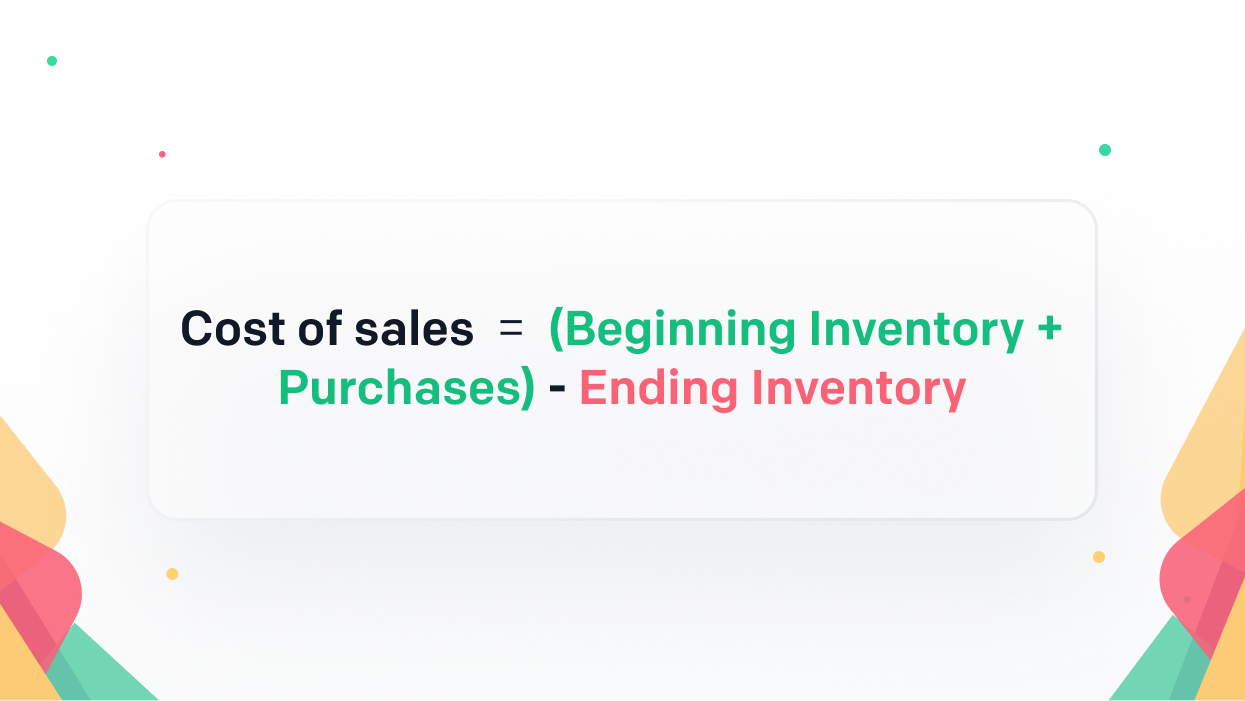

Cost of sales formula