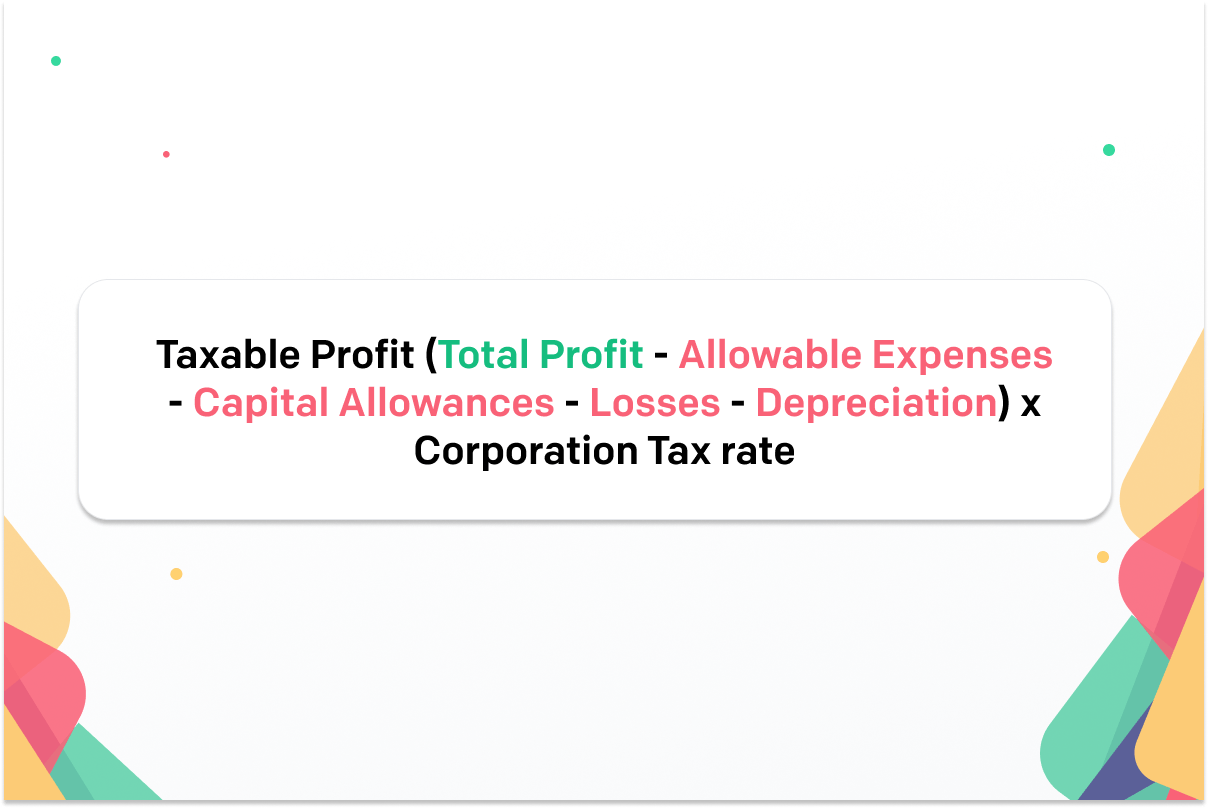

How to calculate Corporation Tax

March 7, 2023How to calculate Corporation Tax

Calculate total profit

Calculate business expenses

Capital allowances

Losses

Corporation Tax rates and thresholds from April 2023

| Rate | 2023 | 2022 |

|---|---|---|

| Small profits rate (companies with profits under £50,000) | 19% | N/A |

| Main rate (companies with profits over £250,000 | 25% | N/A> |

| Main rate (all profits except ring fence profits) | N/A | 19% |

| Marginal Relief lower limit | £50,000 | N/A> |

| Marginal Relief upper limit | £250,000 | N/A> |

| Standard fraction | 3/200 | N/A |

| Special rate for unit trusts and open-ended investment companies | 20% | 20% |