What expenses can I claim as a limited company?

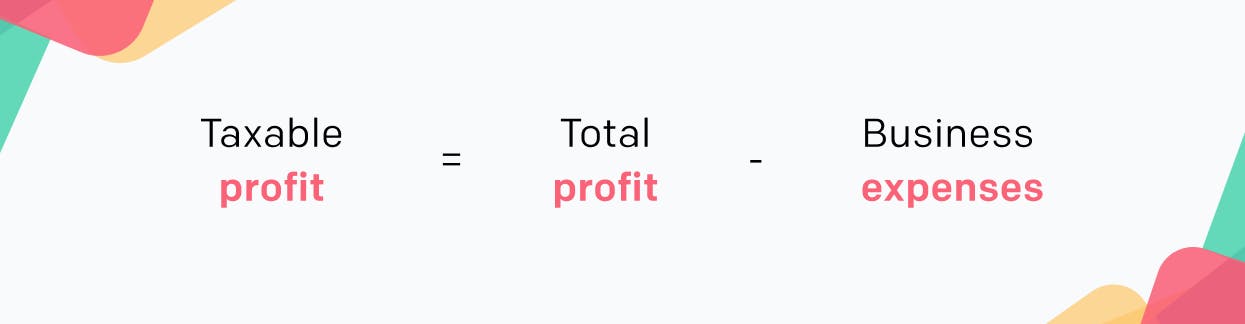

September 23, 2022What are allowable expenses?

What expenses can I claim as a limited company?

Company formation costs

Salaries

Pensions

Office equipment and utilities

Tax relief on advertising, marketing and PR

Working from home: allowable expenses

Can I claim business travel as an expense?

| Vehice | Rate per mile on first 10,000 miles in a tax year | Rate per mile on each mile over 10,000 |

|---|---|---|

| Cars and vans | 45p | 25p |

| Motorcycles | 24p | 24p |

| Bicycles | 20p | 20p |

Is work clothing tax deductible?

Training expenses

Tax deductible medical treatment

Do Christmas parties count as business expenses?

- You’re hosting an annual event — in this example, a Christmas party

- Event is open to all team members

- It costs less than £150 per guest

Business insurance

Are bank fees a business expense?

How do I claim limited company expenses?

- Only claim for the expenses you incur wholly and exclusively during the everyday running of your business.

- If you use an item for business and personal use, you can only claim back the percentage used for business purposes.

- Business expenses can be paid through your company’s bank account, or they can be reimbursed by the company.

- Most expenses can be offset against your company’s Corporation Tax liability.

- To successfully make a claim, you’ll need to keep accurate records of the expenses you make.