What is the VAT registration threshold?

April 28, 2022What is the VAT registration threshold?

| Circumstance | Threshold | What to do |

|---|---|---|

| Total taxable turnover | More than £85,000 | Register for VAT |

| Bringing goods into Northern Ireland from the EU ('acquisitions') | More than £85,000 | Register for VAT |

| Selling goods from Northern Ireland to consumers in the EU ('distance selling') | Total sales across the EU over £8,818 | Register for VAT in EU countries |

| VAT registered taxable turnover | Less than £83,000 | Deregister for VAT (optional) |

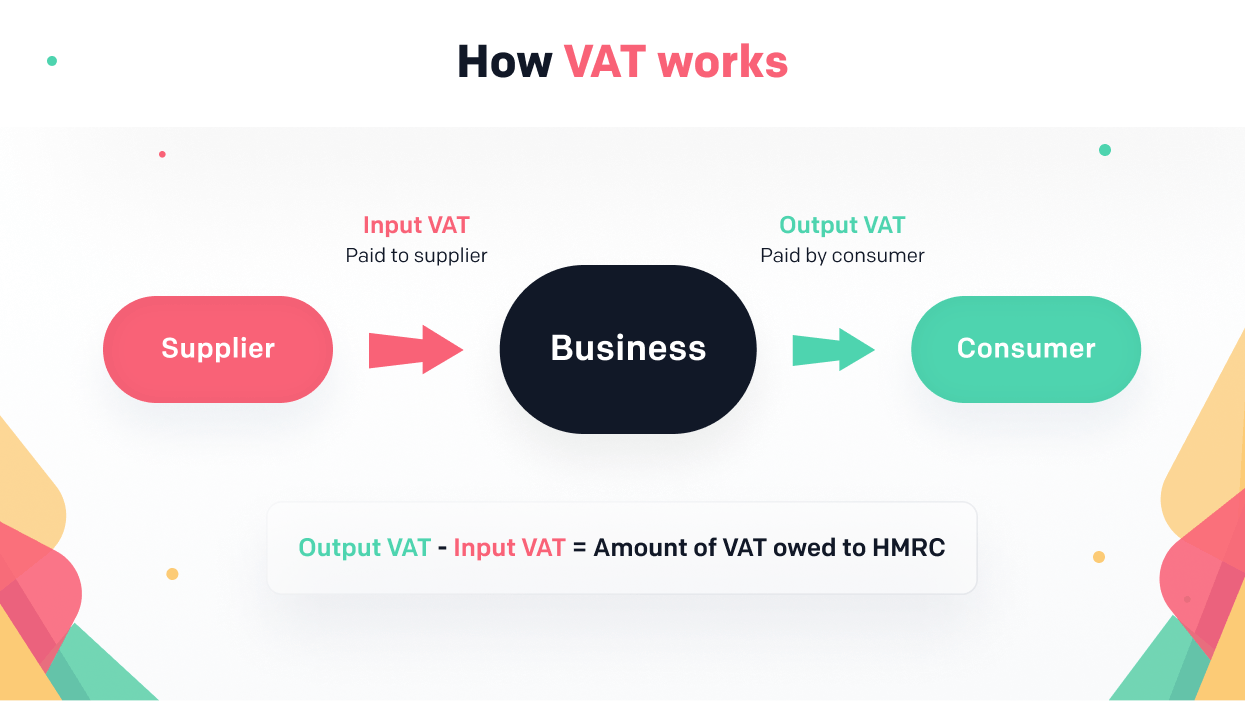

How does VAT work?

Can I register for VAT before I reach the VAT threshold?

Benefits of VAT registration

Drawbacks of VAT registration

VAT accounting scheme thresholds

Flat Rate Scheme

Cash Accounting Scheme

Annual Accounting Scheme

| Threshold to join scheme | Threshold to leave scheme | |

|---|---|---|

| Flat Rate Scheme | £150,000 or less | More than £230,000 |

| Cash Accounting Scheme | £1.35 million or less | More than £1.6 million |

| Annual Accounting Scheme | £1.35 million or less | More than £1.6 million |

When do I need to register for VAT?

I didn't realise I went over the VAT threshold. What now?

| From | VAT registration threshold | VAT deregistration threshold |

|---|---|---|

| 1st April 2010 | £70,000 | £68,000 |

| 1st April 2011 | £73,000 | £71,000 |

| 1st April 2012 | £77,000 | £75,000 |

| 1st April 2013 | £79,000 | <£77,000 |

| 1st April 2014 | £81,000 | £79,000 |

| 1st April 2015 | £82,000 | £80,000 |

| 1st April 2016 | £83,000 | £81,000 |

| 1st April 2017 to present | £85,000 | £83,000 |

VAT registration exceptions

| If you registered... | The penalty rate will be... |

|---|---|

| No more than 9 months late | 5% |

| More than 9 months but no more than 18 months late | 10% |

| More than 18 months late | 15% |