What expenses can a self-employed sole trader claim?

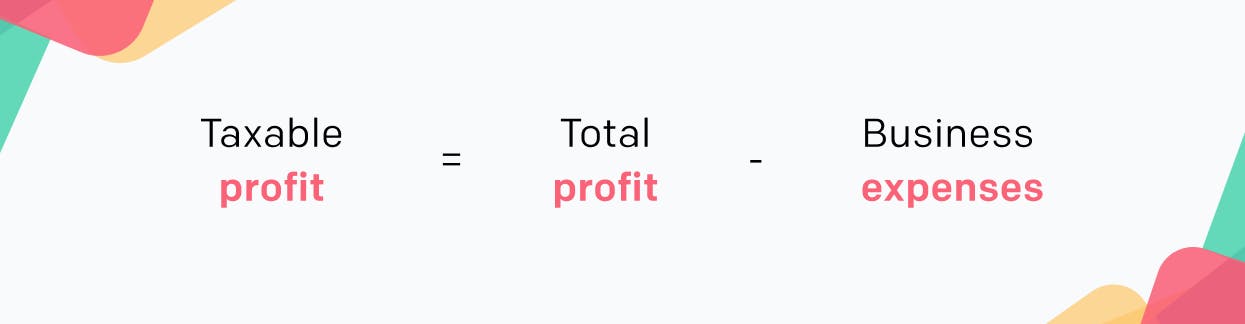

October 14, 2021What exactly are allowable expenses?

Business expenses vs. personal expenses

Keeping track of your expenses

Allowable expenses you can claim as a sole trader

Accounting costs

Advertising & Marketing

Business insurance

Business premises

Clothing

Financial costs

Legal expenses

Software licensing

Staff costs

Stationery and office supplies