What are the legal requirements for sole traders?

June 1, 2022What is a sole trader?

What are the legal and financial requirements to be a sole trader?

Registering for Self Assessment

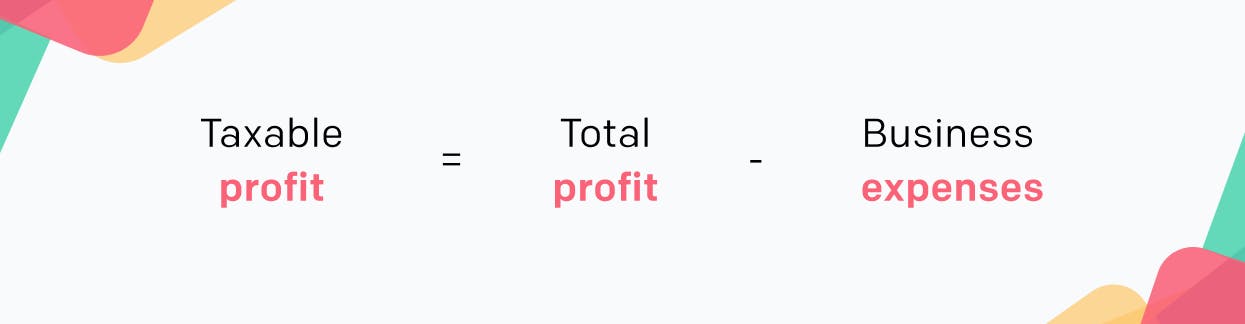

Income Tax

England, Wales and Northern Ireland 2022/23 Tax Bands

| Band | Taxable Income | Tax Rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Basic Rate | £12,571 to £50,270 | 20% |

| Higher Rate | £50,271 to £150,000 | 40% |

| Additional Rate | £150,000+ | 45% |

Scotland 2022/23 Tax Bands

| Band | Taxable Income | Tax Rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Starter Rate | £12,571 to £14,732 | 19% |

| Basic Rate | £14,733 to £25,688 | 20% |

| Intermediate Rate | £25,689 to £43,662 | 21% |

| Higher Rate | £43,663 to £150,000 | 41% |

| Top Rate | £150,000+ | 46% |