What is a current asset?

February 23, 2023What is a current asset?

Examples of current assets

Cash and cash equivalents

Inventory and supplies

Short-term investments

Accounts receivable

Prepaid expenses

Why current assets matter in accounting

How to calculate current assets

Liquidity ratios

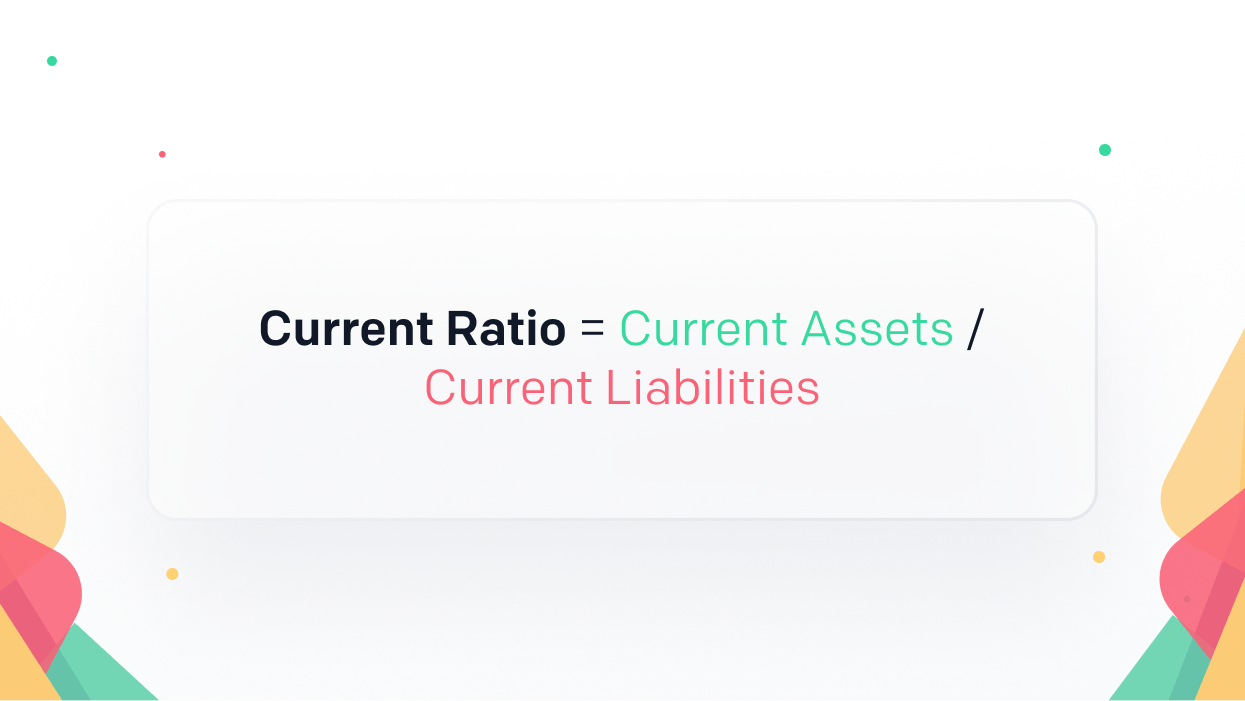

Current ratio

Quick ratio

Net working capital