A guide to paying VAT online in the UK

May 23, 2022Paying VAT online in the UK

| VAT payment type | Transfer time |

|---|---|

| Faster Payments | On the same or next day, including weekends and bank holidays |

| CHAPS | Same day |

| Bacs | 3 working days |

| Direct debit | 3 working days |

| Debit or corporate credit | 3 working days |

| Standing order | 3 working days |

| At your bank or building society | 3 working days (allow up to 6 weeks for the paying-in slips needed to make your payment to arrive) |

Paying VAT online in the UK: Video Guide

How to pay VAT by Faster Payments

How to pay VAT by CHAPS

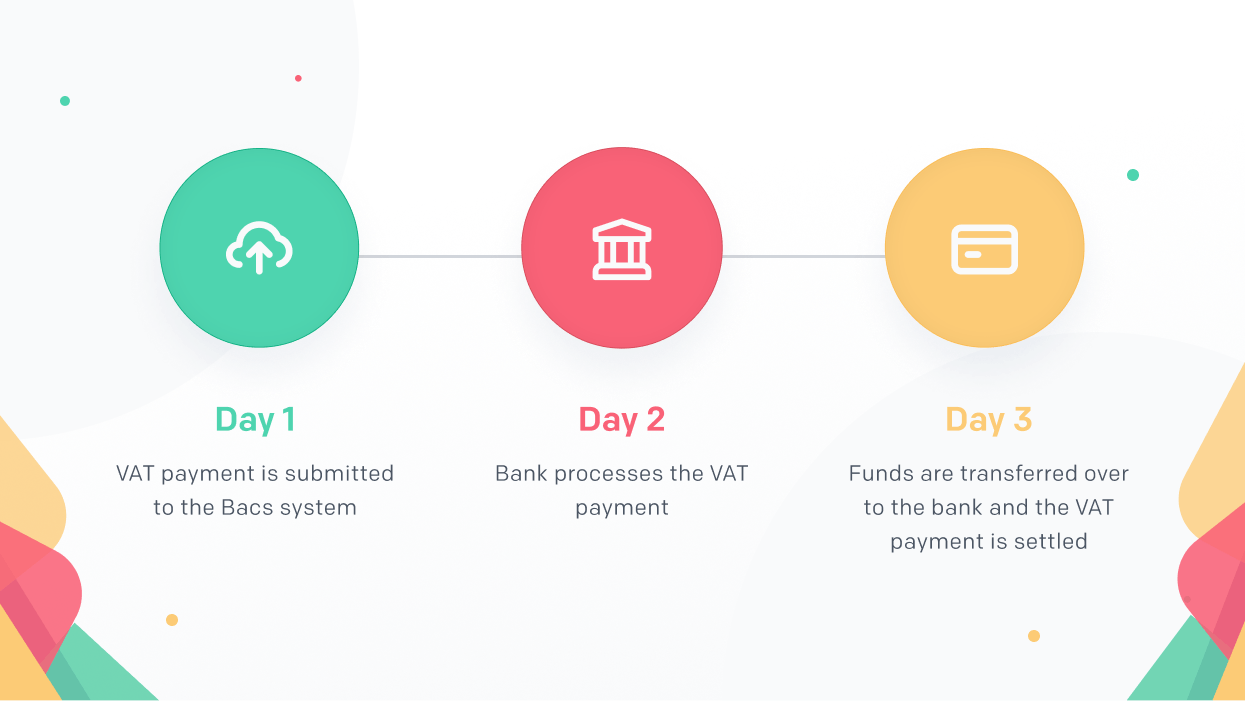

How to pay VAT by Bacs

How to pay VAT by direct debit

How to pay VAT by debit or corporate credit card

How to pay VAT by standing order

How to pay VAT at your bank or building society

What bank details do I need to pay VAT?

| Sort code | Account number | Account name |

|---|---|---|

| 08 32 00 | 11963155 | HMRC VAT |

When do I need to pay my UK VAT bill?

Mistakes to avoid when making a payment

What if I don’t pay my VAT bill on time?

| Defaults within 12 months | Surcharge if annual turnover is less than £150,000 | Surcharge if annual turnover is £150,000 or more |

|---|---|---|

| 2nd | No surcharge | 2% (no surcharge if this is less than £400) |

| 3rd | 2% (no surcharge if this is less than £400) | 5% (no surcharge if this is less than £400) |

| 4th | 5% (no surcharge if this is less than £400) | 10% or £30 (whichever is more) |

| 5th | 10% or £30 (whichever is more) | 15% or £30 (whichever is more) |

| 6 or more | 15% or £30 (whichever is more) | 15% or £30 (whichever is more) |