How to register a limited company

June 28, 2021How to register a limited company

How do I start a limited company?

Directors

Shareholders

Company name

Company addresses

Incorporation documents

Memorandum of association

Articles of association

What are articles of association?

How does a new business adopt Articles?

Certificate of Incorporation

How much does it cost to register a limited company?

Is it worth registering as a limited company?

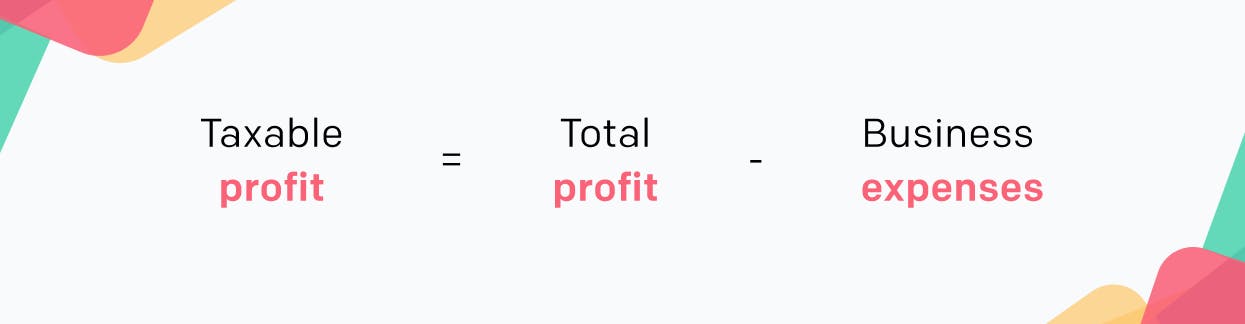

How are limited companies taxed?

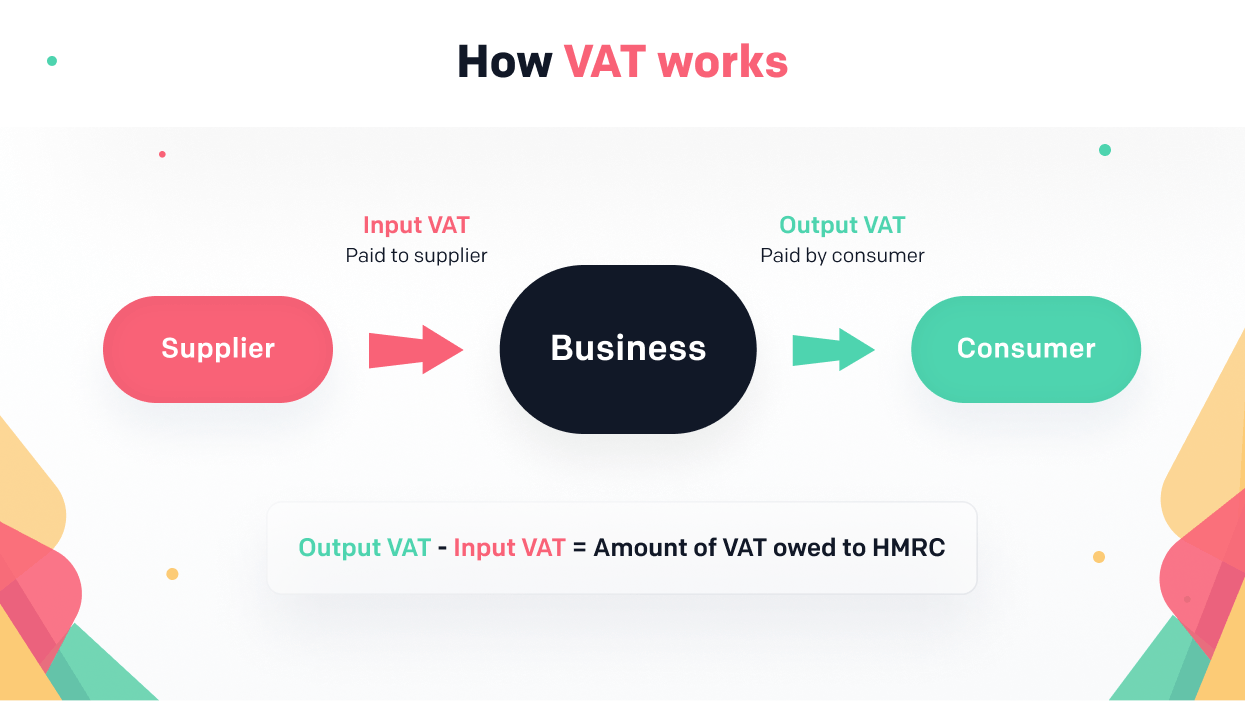

Are limited companies VAT registered?