What is VAT exemption?

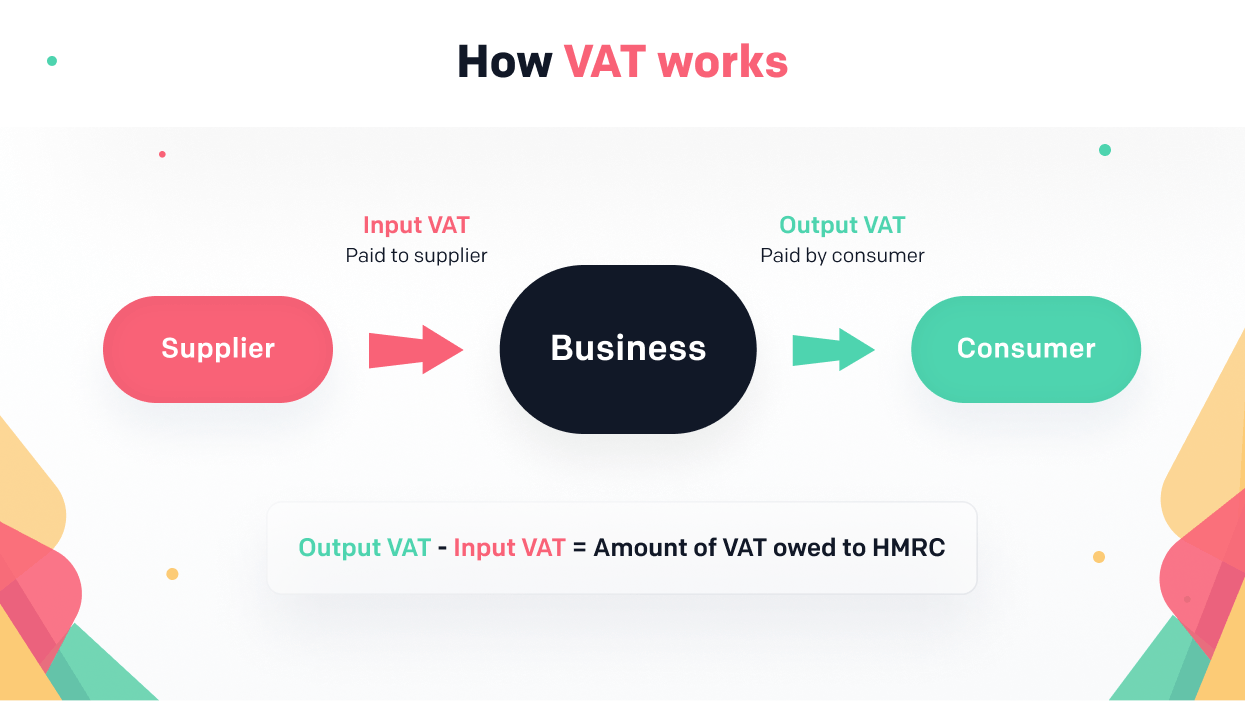

May 9, 2022What is VAT?

What is VAT exemption?

Which goods and services are VAT exempt?

What does VAT exemption mean for my business?

VAT exemption, zero-rated and 'out of scope'

Out of scope

Zero-rated

Should I apply for VAT exemption?

| Benefits of VAT exemption | Drawbacks of VAT exemption |

|---|---|

|

|

|