How do I know if I've signed up for Making Tax Digital for VAT?

September 9, 2022How do I know if I’ve registered for Making Tax Digital?

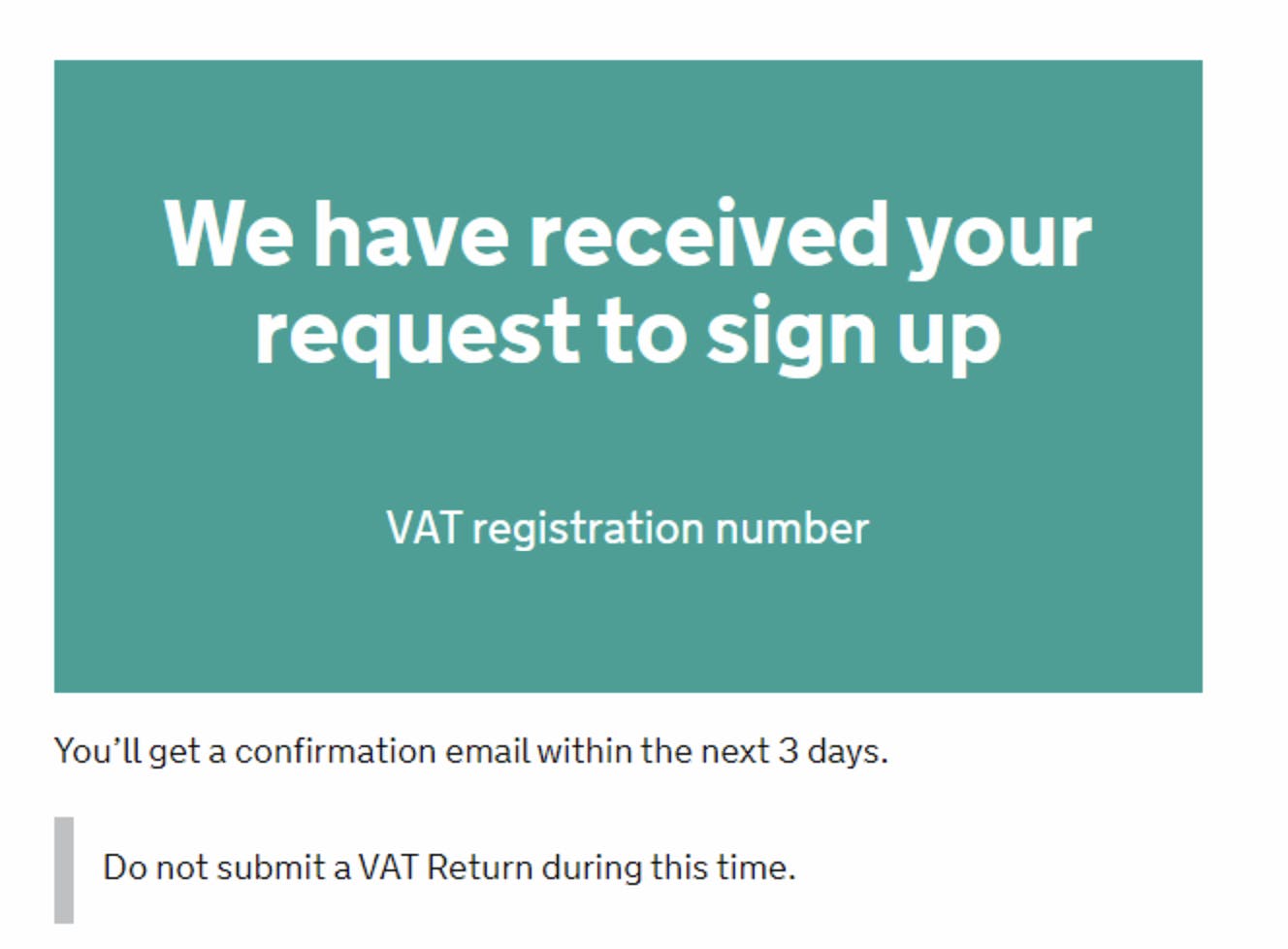

How to register for MTD for VAT

Have MTD-compatible software in place

Declare how you keep your records

Sign in using Government Gateway

Provide information about you and your business

| Legal Structure | Additional Information |

|---|---|

| Sole trader | |

| Limited company | |

| Partnership | |

| Limited Liability Partnership (LLP) |