What is a VAT receipt?

September 22, 2022What is a VAT receipt?

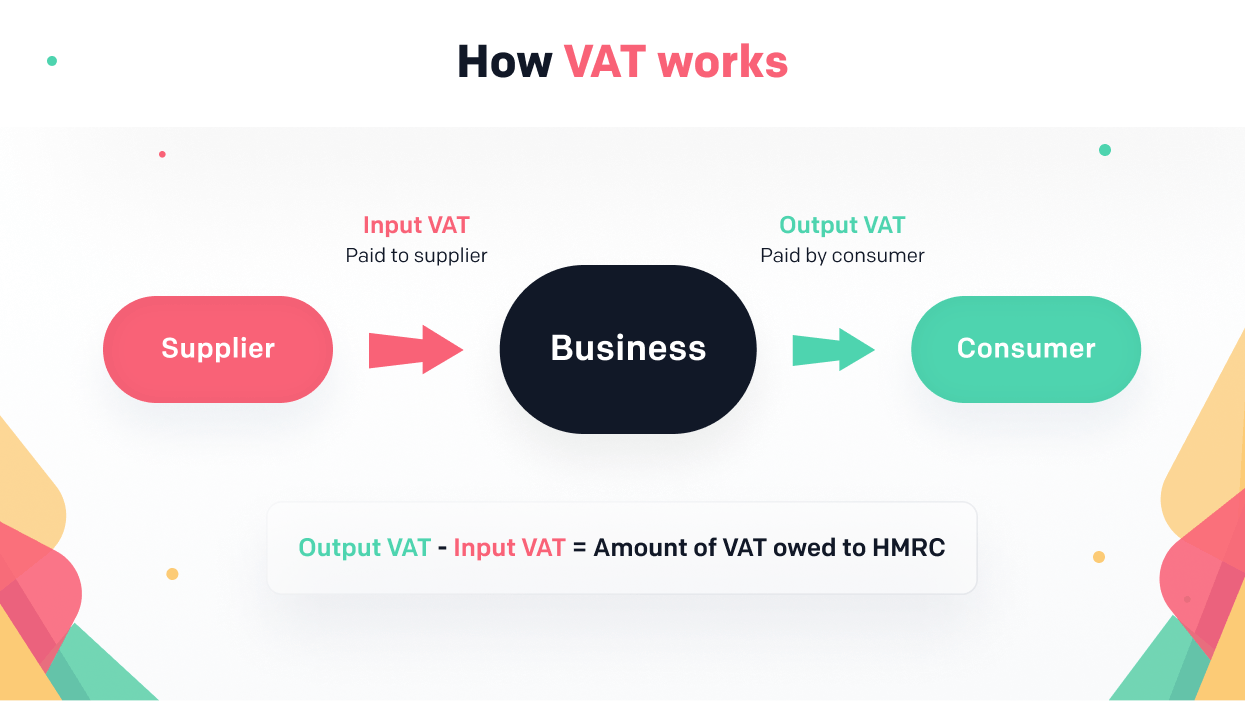

What is VAT?

What’s the difference between a VAT receipt and a VAT invoice?

VAT invoice requirements

What does a simplified VAT receipt look like?

What if I lose my VAT receipt?

VAT record keeping: best practices

VAT account example

| Input tax | £ | Output tax | £ |

|---|---|---|---|

| VAT paid on business expenses | VAT charged on sales | ||

| January | 2,215.23 | January | 2,780.23 |

| February | 1,626.47 | February | 2,305.81 |

| March | 2,792.01 | March | 3,302.45 |

| Sub-total | 6,633.71 | Sub-total | 8,388.49 |

| Other adjustments (specify) | Other adjustments (specify) | ||

| Total tax deductible | 6,633.71 | Total tax payable | 8,388.49 |

| Payable to HMRC | 1,754.78 |